Renters Insurance in and around Walnut Creek

Looking for renters insurance in Walnut Creek?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented apartment or space, renters insurance can be the right decision to protect your valuables, including your entertainment center, hiking shoes, books, tablet, and more.

Looking for renters insurance in Walnut Creek?

Your belongings say p-lease and thank you to renters insurance

Why Renters In Walnut Creek Choose State Farm

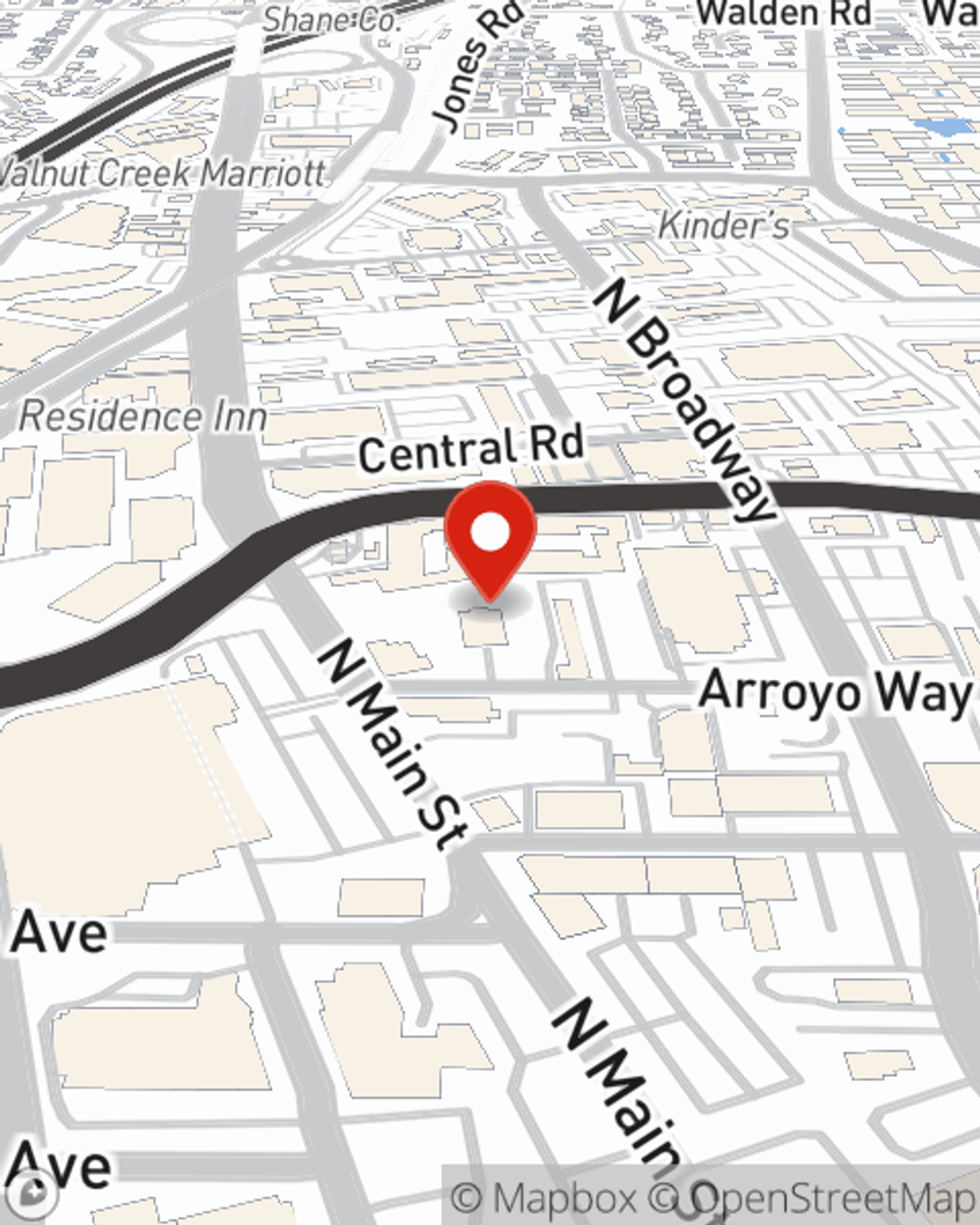

When renting makes the most sense for you, State Farm can help shield what you do own. State Farm agent John Villanueva can help you create a policy for when the unpredictable, like a fire or an accident, affects your personal belongings.

There's no better time than the present! Contact John Villanueva's office today to learn more about State Farm's coverage and savings options.

Have More Questions About Renters Insurance?

Call John at (925) 954-4667 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

John Villanueva

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.