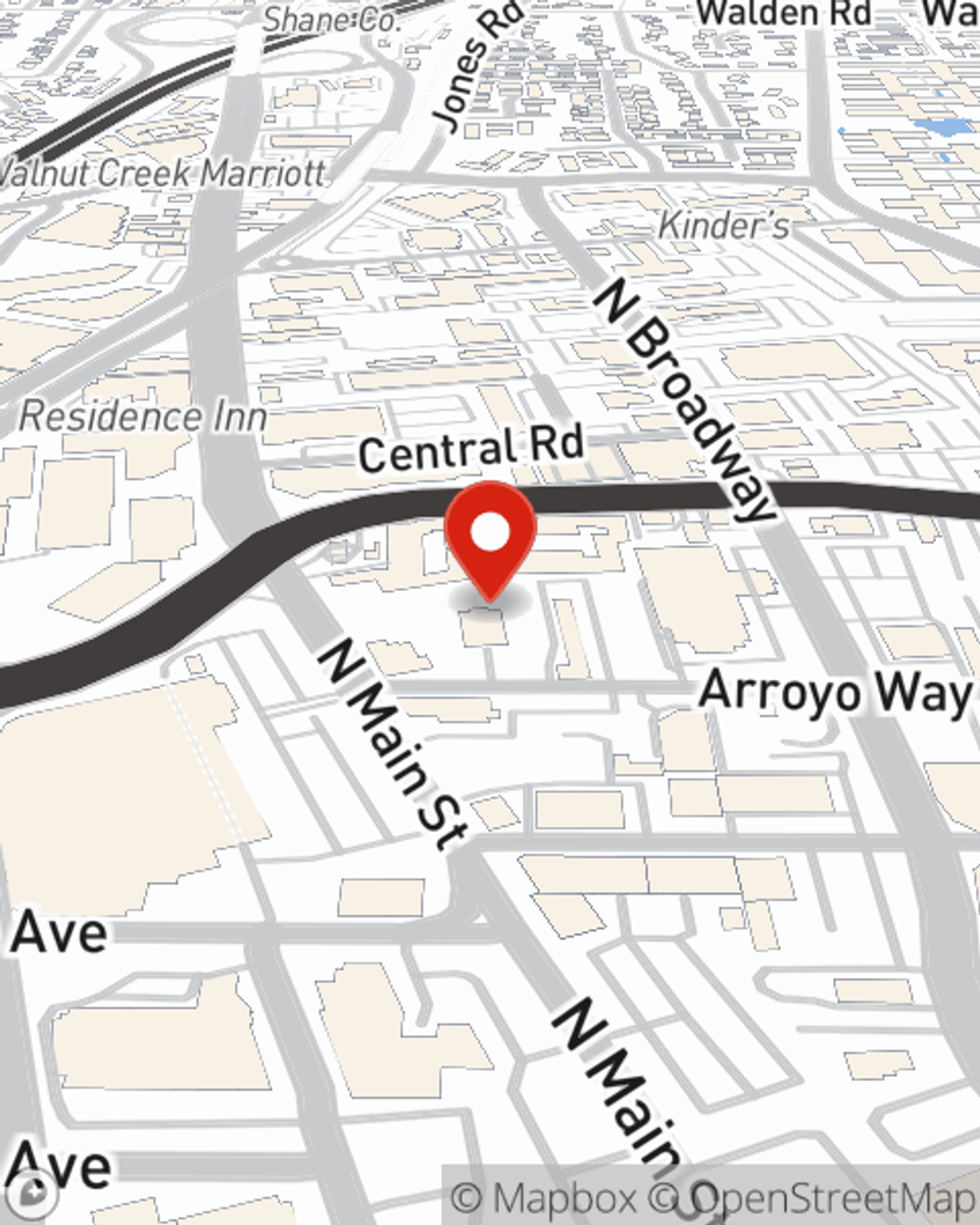

Business Insurance in and around Walnut Creek

Walnut Creek! Look no further for small business insurance.

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent John Villanueva help you learn about your business insurance.

Walnut Creek! Look no further for small business insurance.

Almost 100 years of helping small businesses

Cover Your Business Assets

Whether you are a physician a dog groomer, or you own a pottery shop, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent John Villanueva can help you discover coverage that's right for you and your business. Your business policy can cover things such as equipment breakdown and computers.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Call or email State Farm agent John Villanueva's team today to explore the options that may be right for you.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

John Villanueva

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.